Holding Crypto Too Long? 5 Hard Truths Crypto Traders in Nigeria Need to Hear

Holding crypto: The term “HODL” has grown from slang to a belief system in crypto. The word born from a typo on a Bitcoin forum has become a mantra for millions of crypto investors who chose to ride out the volatility of cryptocurrencies. And while this long game might be wise for crypto assets like Bitcoin and Ethereum, blindly holding on to every coin is not a smart approach to crypto investments.

Timing your exit in crypto is a herculean task, and experienced investors understand the pain of watching all your gains vanish. Read on as we break down five likely scenarios you could find yourself in when you hold your crypto too long.

You Miss The Pump

Cryptocurrencies are popular for erratic price movement, and these can be tough for inexperienced investors to navigate. For example, a coin can pump 400% in a week and then see a 60% correction the following week. It’s typical to expect crypto assets to hold on when they’ve shown strength like that, but holding on may continue to erode your gains.

The smart mindset would be not to let greed cloud judgment. It’s always important to establish clear exit strategies and lock in profits as they go. Experts advise using multiple take profits to shave off gains slowly as the coin pumps. At the same time, trailing stop losses can help you protect the gains against negative movements following a price pump. Remember, your profits are just numbers on a screen unless you hit sell.

Your Coin Loses Relevance

The progression of the crypto market over the years highlights its fast pace. Crypto technology has evolved over the years, such that the hottest coins last year might be ghost towns today. Usually, crypto assets are tied to specific use cases that render them relevant. Bitcoin is popular as a decentralized peer-to-peer coin, while Ethereum has been able to build on that as a decentralized network for smart contracts and dApps.

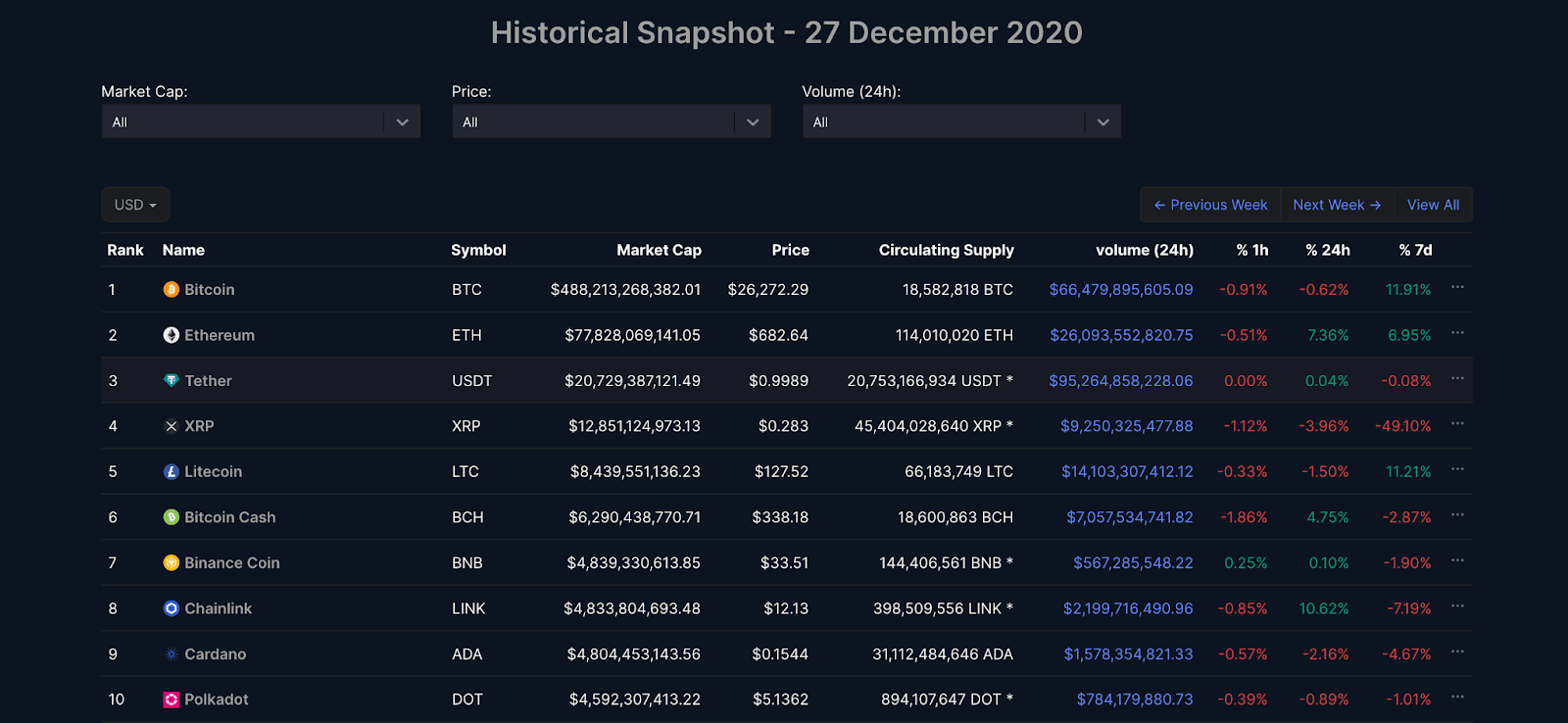

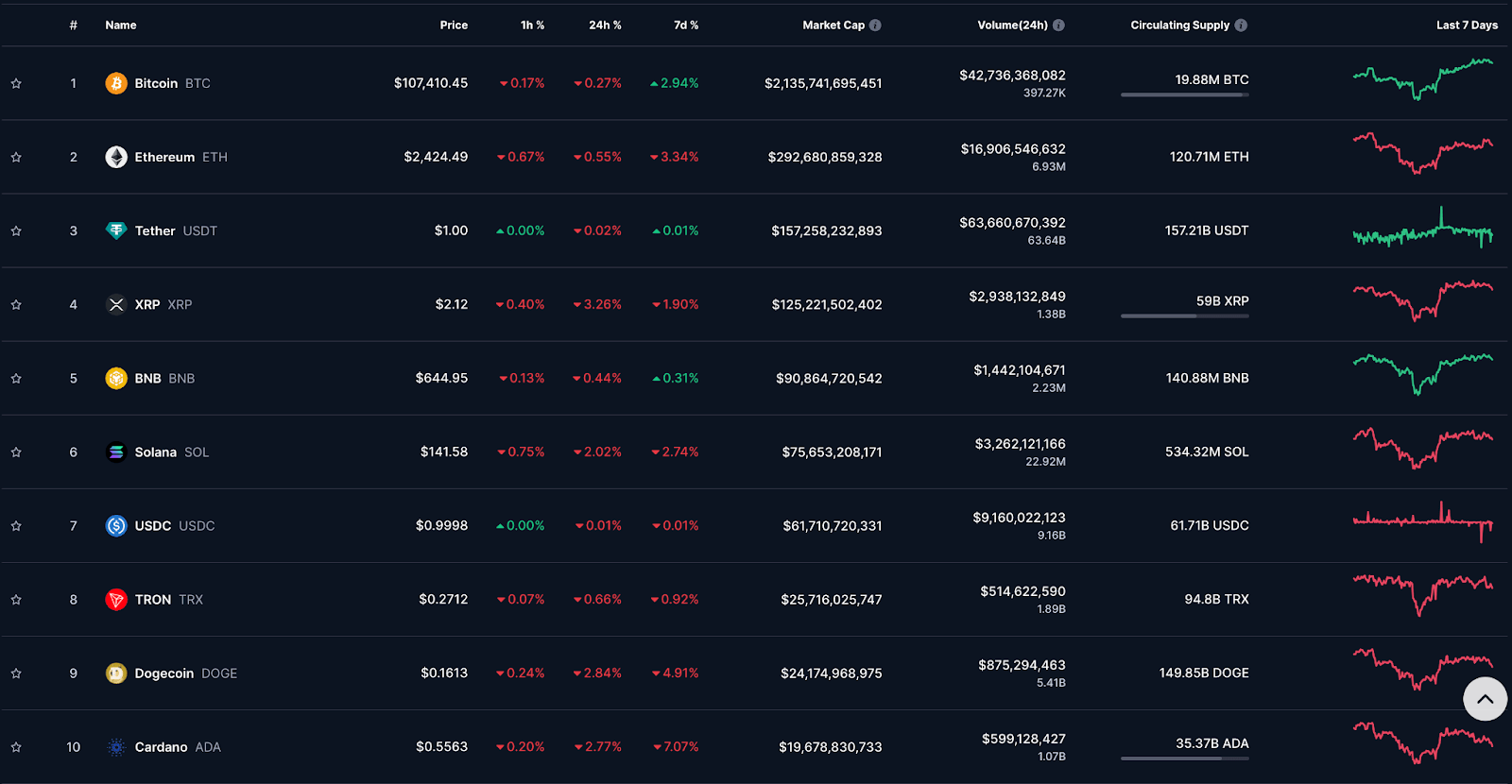

Below are two separate pictures; the first is a snapshot of the top 10 cryptocurrencies in 2020, and the second is the current top 10.

The changes in position or non-existence of cryptocurrencies on the top 10 list highlight some key changes over the past five years. Examples of these changes include technological stagnation, stronger competitors, or a shift in community interest.

These changes can be more evident when examining smaller altcoins. In the past year alone, momentum in the crypto market has shifted from Chinese coins, AI coins, RWA coins, layer-2 coins, meme coins, etc.

This attention shift usually means rotation of capital by large funds and other market makers. As such, investors late in reallocating their funds may be caught holding the bag.

You Underperform Bitcoin or Stablecoin

Sometimes your altcoins can bleed slowly while Bitcoin, Ethereum, or the broader market rallies. It’s one of the sneakiest opportunities in crypto when you’re holding an altcoin down 70%, thinking it will bounce back. Meanwhile, an earlier conversion to Bitcoin could have yielded over 100% gains. Worse, you could have converted to stablecoins to earn yields or save from further losses. Dtunes.ng allow you to convert crypto to Naira instantly, locking your gains without issues.

It’s not a bad idea to benchmark your altcoins to Bitcoin. There’s no point holding an altcoin if it can outperform BTC. Investing in crypto is about allocating smartly, and holding amid price weakness may not always be the best move.

You Ignore Market Cycles

Many investors have held cryptocurrencies through euphoric peaks only to ride the coin back down. The crypto market moves in cycles: bull cycle, bear cycle, accumulation, hype, distribution, etc. Coins like Shiba Inu (SHIB) had one of the best crypto rises in history. Despite its $6 billion market capitalization today, it’s over 87% down from its all-time high.

Hoping for a rebound on a dead coin is not a strategy. Smart investors study market cycles and can adjust accordingly to hype, volume spikes, parabolic growth, etc. Responding to these market situations may mean rotating to safer assets, scaling out, or just exiting when market greed is high.

It’s popular advice in crypto not to marry your bags. Long-term success in crypto is in knowing how to capitalize on market momentum.

You Get Emotionally Attached To A Coin

Holding a coin too long can get you emotionally attached to it. Being a rational investor is hard when you’ve fallen in love with a token. You’ll face the reality when the hype fades and red flags start to show. These warning signs can include poor tokenomics, delayed roadmaps, inactive developers, or even the quiet exit of the founding team.

In cases like this, you may dismiss better-performing alternatives or downplay negative news about the coin. Detachment is a superpower in crypto and a crucial skill of some of the best crypto investors/traders.

When Should You HODL?

The key factor when holding a cryptocurrency is conviction. And you build conviction by targeting coins backed by logic and fundamentals. Cryptocurrencies like Bitcoin and Ethereum have seen diamond hands holding through multi-year cycles due to their strong fundamentals.

The pitfall for several investors is finding early-stage projects with the potential for huge growth. This strategy, backed by research and milestone tracking, can help investors find early projects to HODL. However, it’s important to maintain objectivity when holding cryptocurrencies for the long haul. And when you decide to take profits or rotate your assets into more profitable alternatives, Dtunes.ng helps Nigerians convert crypto to cash securely.

Godwin has spent the last 5 years making SEO magic happen and now leads as SEO Manager at Dtunes. When he’s not tweaking search rankings, you’ll catch him vibing to music, playing games, or hanging out with friends.