What’s the Maximum Supply of Bitcoin that Will Ever Exist?

What's the Maximum Supply of Bitcoin? The maximum supply of Bitcoin is capped at 21 million coins. This means that only 21 million bitcoins will ever exist. Once this supply is used up, that will be all.

Bitcoin is one of the first cryptocurrencies to ever exist. It is in fact the first and oldest cryptocurrency. Even if you were living under a rock, you’ve probably come across Bitcoin one way or another.

If you’re new to the world of cryptocurrencies, this article talks about the maximum supply of Bitcoin that will ever exist. So, if this looks like what you’re interested in, then keep reading.

Let’s run it back just a little bit. Starting from the basics…

What is cryptocurrency?

Cryptocurrency is a revolutionary form of digital or virtual currency that uses cryptography to secure financial transactions, control the creation of new units, and verify asset transfers. Unlike traditional fiat currencies, cryptocurrencies operate on decentralized networks based on blockchain technology. Bitcoin, Ethereum, Ripple, and Litecoin are some of the well-known cryptocurrencies that have gained global recognition.

Now, where were we?

What is Bitcoin?

Bitcoin is a decentralized digital currency that operates without the need for a central authority, such as a bank or government.

Bitcoin was introduced in 2009 by an anonymous person or group known as Satoshi Nakamoto, and was designed as a peer-to-peer system that enables users to send and receive payments directly without intermediaries. This means that you didn’t have to go to the bank or go through a third-party (or middleman) to send and receive Bitcoin payments like you would for your traditional currencies.

Bitcoin transactions are recorded on a public ledger called the blockchain, which ensures transparency and security. Transparency which means that anyone can view Bitcoin transactions, download and inspect them, and security which means that it is very difficult to manipulate data on the blockchain, because everyone on the network will see what happened if they tried to.

Bitcoin has some unique attributes, one of it being that it has a finite supply, and this is what makes it different from your regular traditional currencies like Naira, Dollar, Pound, Yen, and so on.

Unlike traditional currencies, or fiat money as it is popularly called, which banks with approval of the government can print more money, Bitcoin’s supply is limited. Once that supply is used up, it is done. There will be no more ‘printing’.

This characteristic of Bitcoin is known as ‘Scarcity’, and is a major factor influencing its value and also differentiating Bitcoin from other forms of money.

Bitcoin’s Limited Supply

The maximum supply of Bitcoin is capped at 21 million coins. This means that only 21 million bitcoins will ever exist. Once this supply is used up, that will be all. But how’s this even possible? A fundamental feature embedded in its code by Satoshi Nakamoto is how it will happen. This limitation was established to create a digital currency with scarcity, similar to precious metals like gold. Because if something is scarce, it has more value, right? Exactly!

For us to understand why Bitcoin’s supply is capped, it’s important to look at the principles behind its design.

The first one is prevention of inflation. One of Bitcoin’s main goals was to prevent inflation caused by excessive money printing in traditional financial systems. When banks and governments agree to print more money and there is more money in circulation, then there is bound to be inflation. A limited supply of Bitcoin ensures that Bitcoin maintains its value over time.

The second one is decentralization. The concept of centralization and decentralization is practically the foundation of fiat money and Bitcoin. Fiat money is typically issued and regulated by centralized authorities such as central banks. They have the authority to create, control and manage the supply of fiat money such as the Naira. They have the power to make decisions regarding how money will be circulated and also policies regarding money.

In contrast, Bitcoin operates on a decentralized network. It is not controlled by any central authority. This means that no single person has full control over the creation, supply, and even regulation of Bitcoin.

Also, by mimicking the finite nature of physical commodities like gold, Bitcoin establishes itself as a “store of value.”

How was Bitcoin created?

Bitcoin is powered by open-source code or technology called the blockchain. Blockchain is like data stored in blocks. These blocks are linked by chain-like structures and managed by a group of users.

Users on the Bitcoin network verify transactions through mining, which is also a process through which Bitcoin is created.

This mining process involves using computational power to solve complex mathematical puzzles. Miners validate transactions on the Bitcoin network and add them to the blockchain. As a reward for their efforts, they receive newly created bitcoins.

Mining rewards are not infinite. Inside Bitcoin’s code is a mechanism known as halving, which reduces the reward given to miners by 50% approximately every four years (or after 210,000 blocks are mined). When Bitcoin was first launched, the reward for mining a block was 50 BTC. Over time, this reward has undergone several halvings:

2009: 50 BTC per block

2012: 25 BTC per block

2016: 12.5 BTC per block

2020: 6.25 BTC per block

2024: 3.125 BTC per block

You can see that this value decreases, thereby making Bitcoin rarer. This process continues until the reward approaches zero, which is estimated to occur around the year 2140.

What Happens When All Bitcoins Are Mined?

Once the last Bitcoin is mined, miners will no longer receive block rewards. However, they will still earn transaction fees from users sending Bitcoin across the network. These fees are expected to become the primary incentive for miners to continue validating and securing the blockchain.

Implications of Bitcoin’s Fixed Supply

Bitcoin’s limited supply has several significant implications for the economy and its users:

Deflationary Nature: Unlike fiat currencies, which can lose value due to inflation, Bitcoin’s scarcity makes it inherently deflationary. Over time, this could increase its purchasing power.

Store of Value: Bitcoin is often compared to gold as a store of value. Its finite supply strengthens its appeal as an asset to preserve wealth.

Long-Term Stability: A predictable supply schedule makes Bitcoin an attractive option for investors and institutions seeking stability.

Potential for High Volatility: While Bitcoin’s scarcity contributes to its value, it also leads to price volatility as demand fluctuates.

Where to Trade Bitcoin in Nigeria

Now that we know and understand the maximum supply of Bitcoin that will ever exist, we should also understand where to trade it. Because how do you learn how to acquire something and not learn how to trade it for cash especially in case of emergencies?

There are so many platforms that you can trade Bitcoin when we’re talking about Bitcoin for beginners. A good example of such platform is Dtunes.

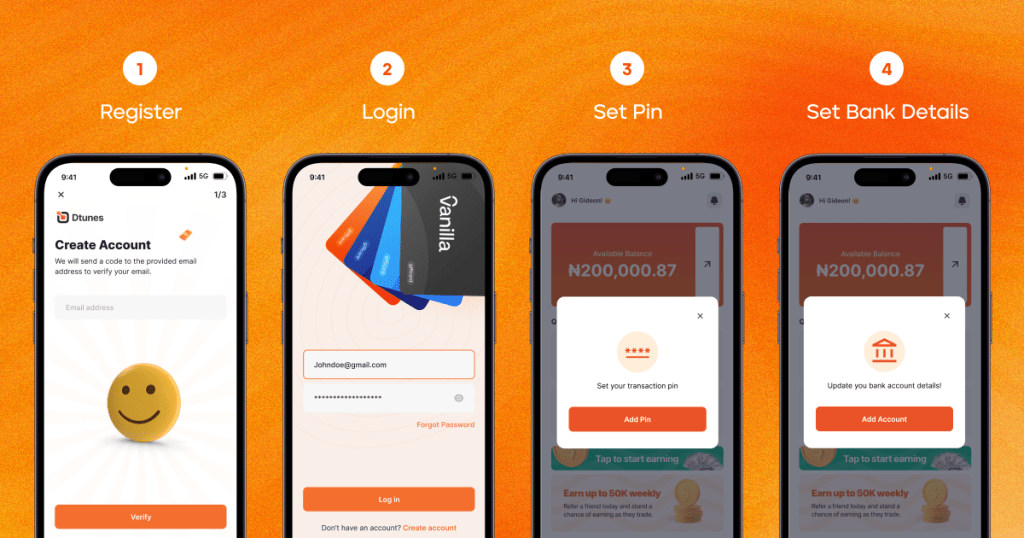

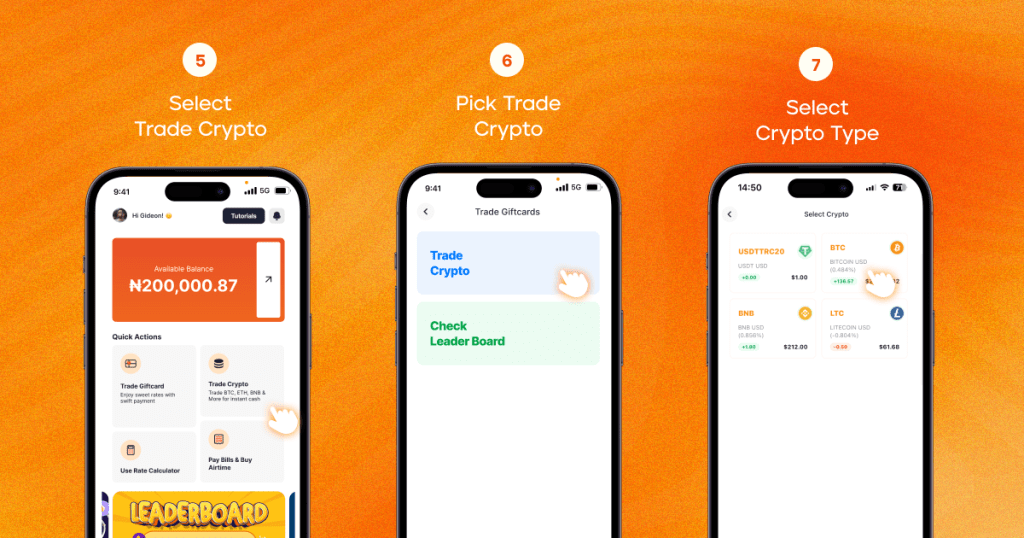

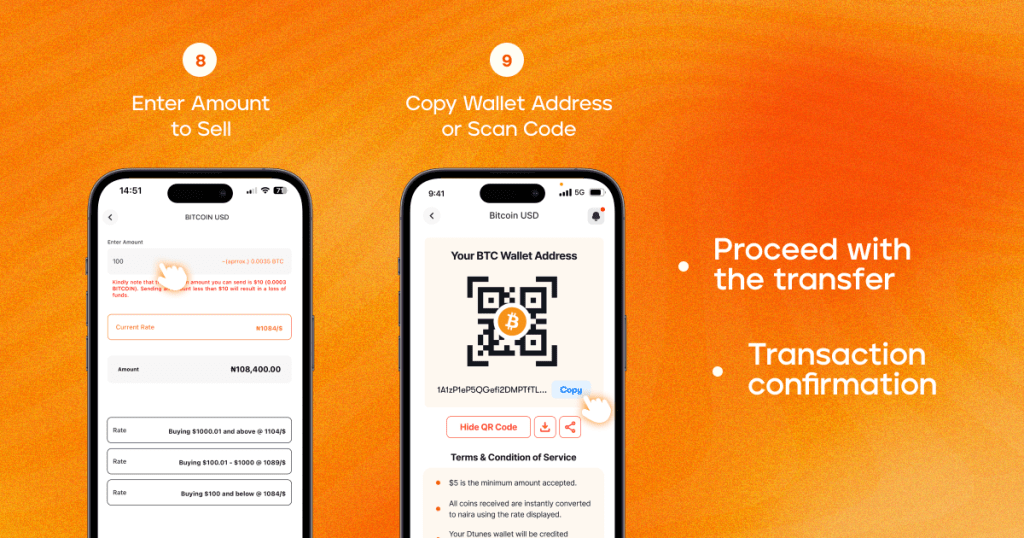

Here’s how you can trade your Bitcoin on Dtunes:

The first thing you want to do is to download the Dtunes app either on the Google Play Store for Android or on the App Store for iOS. Then create an account if you don’t have one. It is free and it takes less than 3 minutes to create

- Log in to your account

- Click on “Trade Crypto”

- Choose “Trade Crypto”

- Select the type of Crypto you want to sell (BTC in this case)

- Enter the amount in USD

The rate is displayed and you can go ahead to sell your BTC.

Conclusion

Bitcoin’s maximum supply of 21 million ensures scarcity and long-term value. This feature has driven its popularity as a decentralized, deflationary currency.

Dtunes is the number one app that allows you to trade your gift cards at juicy rates. Definitely the best rate in town. Yes! That’s how good it is. It is a very seamless way of selling your gift cards in Nigeria. If you’re looking for swift payment, Dtunes is your go-to platform. After transacting, you can withdraw your cash to your bank account without any hiccups.

This app is also iOS and Android compatible.

Tobi brings stories to life as the Content Writer and Creator at Dtunes, blending creativity with strategy to connect with audiences. When she’s not crafting content, you’ll find her traveling, meeting new people, or trying out exciting things.