Key Legal Changes Affecting Bitcoin Trading in Nigeria You Need to Know in 2025

For years, trading Bitcoin in Nigeria felt like hustling in a shady zone; one moment you’re up, the next you’re unsure if you’re not breaking any laws. For this reason, every trader knows to keep updated with the legal changes affecting Bitcoin and crypto in general.

With nearly one in three Nigerians into crypto, and Nigeria ranking in the top two for global crypto use, it’s no surprise everyone’s been asking:

Is crypto finally legal? .. Will the govenment freeze my account soon?

The new Investment and Securities Act (ISA) 2025 has finally cleared the air. This game-changing law lays down clear rules, stronger protections, and a legal framework that gives Nigerian crypto traders and investors real confidence.

Key takeaways

- March 25, 2025: ISA 2025 enacted—digital assets are officially securities.

- SEC now regulates issuance, trading, promotion, and custody.

- VASPs need licensing, capital/bond, governance, KYC/AML, and reporting.

- Penalties: ₦10–20 million fines; jail for fraud.

- CBN is still watching P2P channels.

- Dtunes is ready-made for compliant trading and custody to seamlessly convert Bitcoin to naira solutions.

What does the ISA 2025 mean for crypto?

1. ISA 2025—Cryptos Officially Recognised as Securities

On March 25, 2025, President Tinubu signed the Investments and Securities Act (ISA) 2025, officially classifying cryptocurrencies like Bitcoin as securities.

This is the most significant legal shift in Nigeria’s crypto history, bringing digital assets squarely under the purview of the Securities and Exchange Commission (SEC).

Key Implications of ISA 2025:

1. SEC oversight: Issuance, trading, custody, and promotion of cryptos are all regulated.

2. Penalties for non-compliance: Audits, delisting, freezes, or even criminal charges can follow non-licensed activity.

2. Licensing & KYC/AML Requirements for VASPs

With ISA 2025 in effect, Virtual Asset Service Providers (VASPs) and crypto exchanges must now:

- Secure formal licensing from the SEC.

- Meet the ₦500 million paid-up capital and 25% fidelity bond thresholds.

- Implement robust KYC/AML and other investor-protection mechanisms.

What does this mean for you?

Only SEC-licensed platforms can legally serve Nigerian users, so always check the SEC’s approved list before trading.

3. Controlled Access to Naira Markets

To reduce FX market distortions and protect the naira, regulators are moving to delist NGN pairs from peer‑to‑peer platforms

What traders should know:

- You may no longer directly trade Bitcoin/Naira on P2P.

- Expect to use licensed exchanges offering regulated NGN on/off ramps.

- OTC services may need to go through regulated channels now.

4. Bank Participation Returns with Safeguards

The 2021 CBN banking ban is over. Since late 2023, banks can hold accounts for licensed VASPs. But now, central oversight has intensified; expect closer monitoring and reporting for suspicious activity.

This makes conversions between Bitcoin and naira via banking channels safer and more mainstream.

5. Taxation on Crypto Gains

Tax policy has shifted: gains above ₦10 million may now face a 10% capital gains tax under the Finance Act 2023. Traders should:

- Track and document profits.

- Submit gains over thresholds.

- Consider using tax-compliant VASPs for reporting assistance.

Why These Key Legal Changes Affecting Bitcoin Trading in Nigeria Matter?

These Key Legal Changes Affecting Bitcoin Trading in Nigeria come with economic importance,, such as

1. From grey zone to legitimacy

The new laws replace conflicting CBN warnings (2017, 2021) with formal legal recognition, bringing stability after years in the shadows.

2. Investor protection amplified

Now falling under securities law, Bitcoin investors are entitled to disclosures, dispute resolution via the Investments & Securities Tribunal, and legal recourse against fraud.

3. Regulatory clarity for platforms

Platforms previously shut out by bank bans or forced into P2P channels can now operate openly, once they meet licensing criteria, offering legitimacy to traders.

4. Increased compliance costs

The downside is higher barriers to entry due to capital and compliance demands. Smaller startups may face challenges, possibly consolidating into well-resourced firms.

If you are worried about a legitimate platform to sell, buy or convert bitcoin to naira in Nigeria, then look no further than Dtunes.

5. Impact on Peer-to-Peer Trading

While ISA 2025 governs licensed platforms, the CBN may still restrict Naira use in P2P deals via banks. Watch for further CBN circulars.

6. Tax Implications

The 2023 Finance Act imposed a 10% capital gains tax on digital assets. Traders should keep records for accurate reporting.

With these legal changes,, one platform to trust with everything Bitcoin is Dtunes.

How to Sell Bitcoin in Nigeria with Dtunes

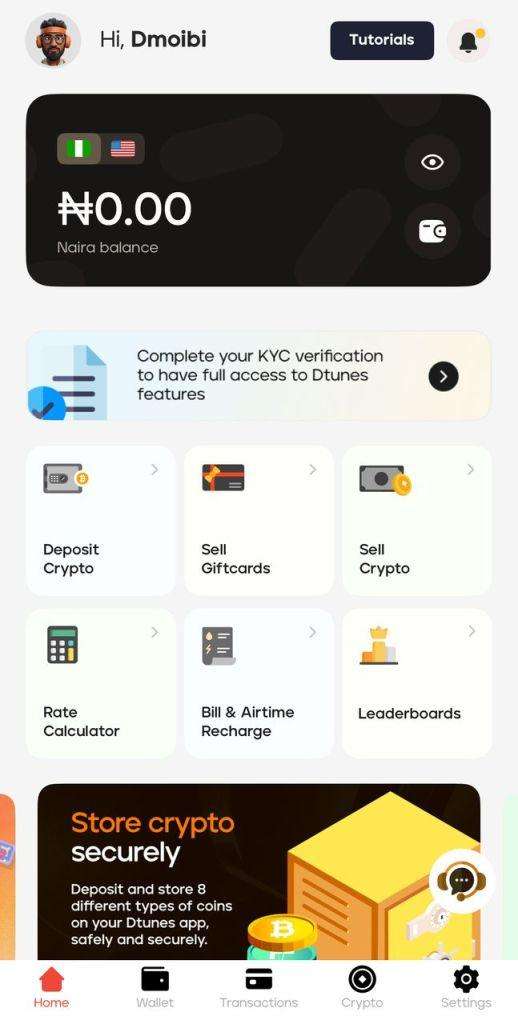

- Download the Dtunes App on Google Play or App store and complete KYC with photo ID and proof of address.

- Deposit BTC: Transfer from your external wallet. Dtunes supports major wallets and ensures HIPAA-grade custody.

- Sell: Choose the BTC/Naira trading pair, set your price, or use the live orderbook.

- Withdraw Naira: Transfer proceeds to your verified bank account.

With Dtunes’ full SEC compliance pipelines in development and built-in AML controls, Dtunes positions itself to be among the first fully licensed platforms under ISA 2025.

Best Wallets to Deposit Bitcoin in Nigeria

- Custodial (exchange-based): Dtunes’s wallet, integrated, insured, compliant.

- Non-custodial: Trust Wallet, Electrum, Ledger Nano S/X, ideal.

How to Convert Bitcoin to Naira on Dtunes

These are the steps to convert Bitcoin to Naira in Nigeria;

1. Download the Dtunes App on Google Play or App store

2. Sign In or Create an Account (use your phone number or email and set up a secure password)

3. Set Up Your Account (Link your Nigerian bank account and enable biometric login for extra security)

4. Click “Sell Crypto” on the Home Page

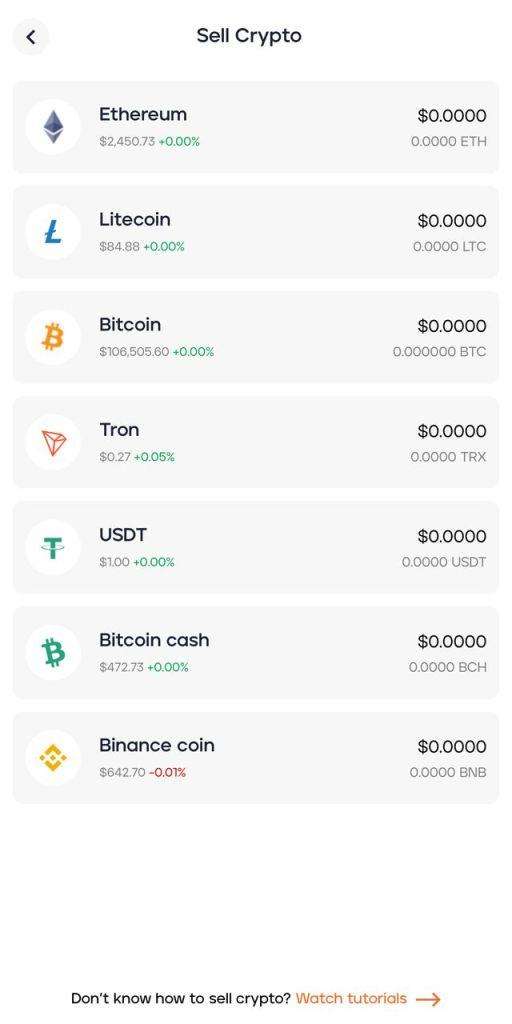

See all crypto to sell:

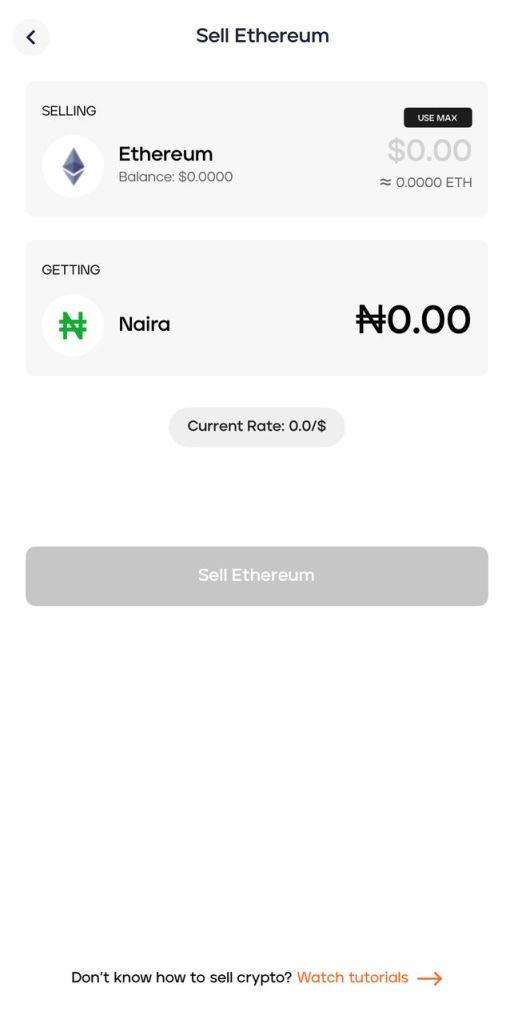

5. Choose the coin you want to sell (e.g. Bitcoin, Ethereum, USDT)

6. Enter the Amount You Want to Sell (You’ll instantly see the Naira equivalent)

7. Click “Sell” (You’ll receive the payment in your connected bank account in minutes)

The process is smoothest if you’ve already deposited your crypto to your Dtunes wallet.

Can Bitcoin be Tracked Legally?

Yes, the SEC now has the power to subpoena telecom and internet data to curb fraud, manipulation, and insider trading.

Frequently Asked Questions (FAQs)

1. Is Bitcoin legal in Nigeria in 2025?

As of March 25, 2025, Bitcoin and other digital assets are legally recognised as securities under ISA 2025.

2. What must crypto exchanges do to operate legally?

They need to register with the SEC, meet capital bonds, institute KYC/AML, maintain governance frameworks, and await license issuance.

3. What penalties exist for non-compliance?

Expect fines from ₦10 million (promotional breaches) to ₦20 million plus prison up to 10 years (Ponzi, fraud). License revoked + criminal charges are possible .

4. Are P2P Bitcoin trades banned?

Not yet—but CBN has pressured banks to delist Naira from P2P trades. Future regulation may limit these channels.

5. How do I report a scam or fraud?

Report via the SEC (licensed platform reporting), file disputes at the Investments & Securities Tribunal, or contact the Nigerian Consumer Protection Council.

Conclusion

Key legal changes affecting Bitcoin trading in Nigeria have transformed it from a regulatory no-man’s-land into a structured, regulated investment class.

With Bitcoin trading in Nigeria now legally under SEC oversight, traders benefit from clarity, protection, and legitimacy.

Platforms like Dtunes are well-positioned to lead this shift, though rising compliance requirements mean smaller operators need strong infrastructure or risk consolidation.

ISA 2025 is a milestone for crypto’s future in Nigeria.

For More Crypto-Related Posts, See

- Best P2P Crypto Exchanges in Nigeria

- 5 Reasons and Benefits of Holding Cryptocurrency in 2025

- How to Start Saving with Tether USDT, Cryptocurrency

- How to Sell Bitcoin Cash (BCH) in Nigeria: The Expert’s Guide

- Exploring the Concept of Crypto Banking

- USDC vs USDT: All You Need To Know

- How to Sell USD Coin (USDC) in Nigeria

- How to Sell Solana (SOL) in Nigeria

- Hold, Sell, and Manage Crypto Like a Pro with Dtunes 2.0

- Binance Coin (BNB) in 2025: A Beginner’s Guide to Crypto’s Strongest Assets

- How to Sell Litecoin For Cash In Nigeria

- What is Ethereum, Smart Contracts, Gas Fees, Mining & Use Cases

- How to Sell Ethereum In Nigeria At The Best Rate

Godwin has spent the last 5 years making SEO magic happen and now leads as SEO Manager at Dtunes. When he’s not tweaking search rankings, you’ll catch him vibing to music, playing games, or hanging out with friends.