Steps to Send Bitcoin on PayPal

Steps to Send Bitcoin on Paypal: In today’s digital age, the integration of cryptocurrencies into mainstream financial platforms has become increasingly prevalent. One notable platform that has embraced this trend is PayPal, a globally recognized online payment system. With the growing popularity of cryptocurrencies like Bitcoin, PayPal has introduced features allowing users to send and receive Bitcoin directly through its platform. In this comprehensive guide, we will explore the steps involved in sending Bitcoin on PayPal, elucidating the process and discussing its benefits and disadvantages.

What is Bitcoin?

Before delving into the specifics of sending Bitcoin on PayPal, it’s essential to understand what Bitcoin is. Bitcoin, often referred to as digital gold, is a decentralized digital currency that enables peer-to-peer transactions without the need for intermediaries such as banks or governments. It operates on a technology called blockchain, which ensures transparency, security, and immutability of transactions. Bitcoin has gained significant traction as a store of value and a medium of exchange, with its value subject to market demand and supply dynamics.

What is PayPal?

PayPal is a leading online payment platform that facilitates transactions between individuals, businesses, and merchants. Founded in 1998, PayPal has emerged as a convenient and secure way to send and receive money globally. Users can link their bank accounts, debit cards, or credit cards to their PayPal accounts, enabling seamless fund transfers and online purchases. PayPal offers various services, including PayPal Checkout, PayPal.me, and PayPal Business, catering to the diverse needs of its users.

Benefits of Sending Bitcoin on PayPal

The integration of Bitcoin into PayPal presents several benefits for users:

- Convenience: By allowing Bitcoin transactions within its platform, PayPal offers added convenience to users who wish to manage both traditional and digital assets in one place. Users can easily buy, sell, or hold Bitcoin alongside their regular PayPal transactions.

- Accessibility: PayPal’s extensive user base and global reach make Bitcoin more accessible to a broader audience. Users who may not be familiar with dedicated cryptocurrency exchanges can leverage PayPal’s familiar interface to engage with Bitcoin.

- Security: PayPal implements robust security measures to protect users’ funds and personal information. By leveraging PayPal’s security infrastructure, users can mitigate the risks associated with storing and transacting Bitcoin on less secure platforms.

- Integration with Merchants: PayPal’s integration of Bitcoin extends beyond peer-to-peer transactions; it also allows merchants to accept Bitcoin payments for goods and services. This integration enhances the utility of Bitcoin as a medium of exchange in the e-commerce ecosystem.

- Instant Settlements: Transactions conducted with Bitcoin on PayPal can benefit from instant settlements, enabling faster access to funds compared to traditional banking systems, which may involve delays due to processing times.

Disadvantages of Sending Bitcoin on PayPal

While the integration of Bitcoin on PayPal offers various advantages, it also comes with certain drawbacks:

- Limited Control: When users hold Bitcoin within their PayPal accounts, they relinquish some degree of control over their funds. Unlike private wallets where users control their private keys, PayPal controls the Bitcoin stored in users’ accounts, which could pose risks in the event of security breaches or platform restrictions.

- Centralized Custody: PayPal’s custody of Bitcoin introduces centralization into a decentralized ecosystem. This centralized control contradicts the fundamental principles of decentralization and censorship resistance inherent in Bitcoin and blockchain technology.

- Transaction Fees: PayPal imposes transaction fees on Bitcoin transactions, which can vary depending on factors such as transaction volume and currency conversions. These fees may be higher compared to those charged by dedicated cryptocurrency exchanges or peer-to-peer platforms.

- Regulatory Compliance: As a regulated financial institution, PayPal is subject to regulatory compliance requirements imposed by various jurisdictions. This regulatory oversight may result in limitations or restrictions on Bitcoin transactions, affecting users’ ability to freely transact with Bitcoin on the platform.

- Lack of Privacy: Transactions conducted through PayPal may compromise users’ privacy, as PayPal is obligated to comply with anti-money laundering (AML) and know your customer (KYC) regulations. This requirement may involve the collection and sharing of personal information, undermining the pseudonymous nature of Bitcoin transactions.

Steps to Send Bitcoin on PayPal

Now, let’s delve into the steps involved in sending Bitcoin on PayPal:

- Log in to Your PayPal Account: To initiate a Bitcoin transaction, log in to your PayPal account using your credentials. Ensure that your account is verified and in good standing to access the cryptocurrency features.

- Navigate to the “Wallet” Section: Once logged in, navigate to the “Wallet” section of your PayPal account. Here, you’ll find options to manage your various balances, including traditional currencies and cryptocurrencies.

- Select “Buy” or “Sell” Bitcoin: Depending on whether you intend to buy or sell Bitcoin, select the corresponding option within the “Wallet” section. PayPal allows users to both buy and sell Bitcoin directly from their accounts.

- Enter Transaction Details: Follow the on-screen prompts to enter the transaction details, such as the amount of Bitcoin you wish to buy or sell and the desired payment method. PayPal supports various payment methods, including bank transfers and credit/debit cards.

- Review and Confirm Transaction: Carefully review the transaction details, including the exchange rate, fees, and total amount, before confirming the transaction. Ensure that all information is accurate to avoid any errors or discrepancies.

- Complete Security Verification: Depending on your account settings and transaction activity, PayPal may prompt you to complete additional security verification steps, such as two-factor authentication or biometric authentication.

- Receive Confirmation: Once the transaction is confirmed, you’ll receive a confirmation notification from PayPal indicating that the Bitcoin transaction has been successfully processed. You can view the transaction details and track its progress within your PayPal account.

- Manage Your Bitcoin Balance: After completing the transaction, you can manage your Bitcoin balance within your PayPal account. You can hold your Bitcoin in your PayPal wallet, exchange it for other cryptocurrencies, or transfer it to external wallets or platforms.

An alternative to sending Bitcoin on PayPal

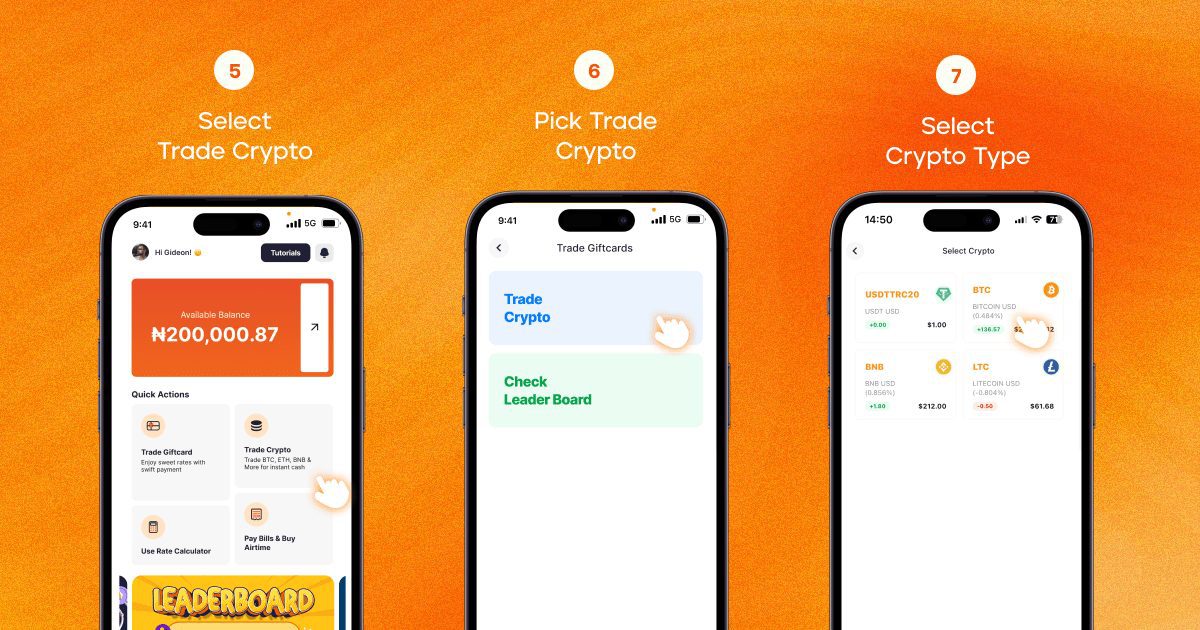

Dtunes offers a straightforward and secure alternative to send Bitcoin on PayPal. To get started, you’ll need to create an account on the Dtunes website or mobile app. The registration process is quick and requires minimal information. After your account is set up, you can proceed to sell your BTC for cash. Here’s a step-by-step guide on how to do it:

- Log into your account

- Click on “Trade Crypto” on the homepage

- Choose “Trade Crypto”

- Choose the type of crypto you want to sell (BTC in this case) and ‘continue’

- Enter the amount, and proceed to trade.

Apart from Bitcoin, Dtunes supports a range of other cryptocurrencies that you can also sell for Nigerian Naira at competitive rates. Some of the supported cryptocurrencies include Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and many more. The platform ensures a secure and efficient transaction process for all supported digital assets, making it a versatile exchange for crypto enthusiasts in Nigeria.

Conclusion

Sending Bitcoin on PayPal opens up new avenues for users to engage with cryptocurrencies within a familiar and trusted platform. While it offers benefits such as convenience, accessibility, and security, users must also be mindful of the potential disadvantages, including limited control, centralized custody, and transaction fees. By understanding the steps involved in sending Bitcoin on PayPal and weighing the associated pros and cons, users can make informed decisions regarding their use of cryptocurrencies within the PayPal ecosystem. As the integration of cryptocurrencies continues to evolve, PayPal’s embrace of Bitcoin signifies a significant milestone in the mainstream adoption of digital assets, paving the way for further innovations in the financial landscape.

Tobi brings stories to life as the Content Writer and Creator at Dtunes, blending creativity with strategy to connect with audiences. When she’s not crafting content, you’ll find her traveling, meeting new people, or trying out exciting things.

![[elementor-template id="6995"]](https://dtunes.ng/blog/wp-content/uploads/2024/08/Latest-DtunesjArtboard-1-copy-41-768x432.jpg)