How Much Is A $100 Vanilla Mastercard In Naira?

While Vanilla Visa and Vanilla Mastercard share several similarities, they also have some key differences

$100 Vanilla Mastercard In Naira: In today’s interconnected world, electronic payment methods have become increasingly popular due to their convenience and efficiency. Prepaid cards, in particular, have gained significant traction for their ease of use and accessibility. Among these, Vanilla Mastercard stands out as a prominent choice, offering users a secure and versatile payment solution. In this article, we will explore the value of a $100 Vanilla Mastercard in Naira, along with its uses and similarities to Vanilla Visa, and how to check the updated Vanilla Mastercard rate in Naira

Vanilla Visa Versus Vanilla Mastercard: Similarities

Before diving into the specifics of Vanilla Mastercard, let’s first examine its similarities with Vanilla Visa. Both Vanilla Visa and Vanilla Mastercard are types of prepaid debit cards that can be used anywhere their respective card networks are accepted. They are not linked to a bank account, providing users with a safer alternative for online and in-store purchases, as they do not expose personal financial information.

Furthermore, these cards are not credit cards, so users can only spend the funds available on the card, preventing overspending and accumulating debt. Both Vanilla Visa and Vanilla Mastercard come in various denominations, making them suitable for different spending needs.

Vanilla Visa Versus Vanilla Mastercard: Differences

While Vanilla Visa and Vanilla Mastercard share several similarities, they also have some key differences. The primary distinction lies in their card networks. Vanilla Visa cards operate on the Visa network, whereas Vanilla Mastercard cards function on the Mastercard network. As a result, the acceptance of these cards may vary based on the merchant’s affiliation with either network.

Additionally, there might be slight variations in fees and features between the two card types. Users are advised to review the terms and conditions of each card before making a decision.

What is Vanilla Mastercard Used For?

Vanilla Mastercard offers a wide range of uses, making it a versatile payment solution for various situations. Here are some common ways to use a Vanilla Mastercard:

- Online Shopping

Vanilla Mastercard can be used for secure online purchases at any e-commerce website that accepts Mastercard payments. It allows users to shop for goods and services from around the world.

- In-store Purchases

Users can use their Vanilla Mastercard at physical retail stores, restaurants, and other establishments where Mastercard is accepted.

- Travel

Vanilla Mastercard can be a convenient companion during travel, whether for booking flights, reserving hotels, or covering other travel expenses.

- Gifts

Vanilla Mastercard is an excellent gifting option, as it allows the recipient to choose their desired items, ensuring they get something they truly want.

- Subscription Services

Many online subscription services, such as streaming platforms, accept Vanilla Mastercard for recurring payments.

- Financial Management

Some people use prepaid cards like Vanilla Mastercard as a budgeting tool to control their spending and avoid overspending.

How much is a $100 Vanilla Mastercard in Naira

The value of a $100 Vanilla Mastercard in Naira depends on the prevailing exchange rate between the US Dollar (USD) and the Nigerian Naira (NGN). Exchange rates fluctuate regularly due to various economic factors, making it essential to check the current rate before making any transactions.

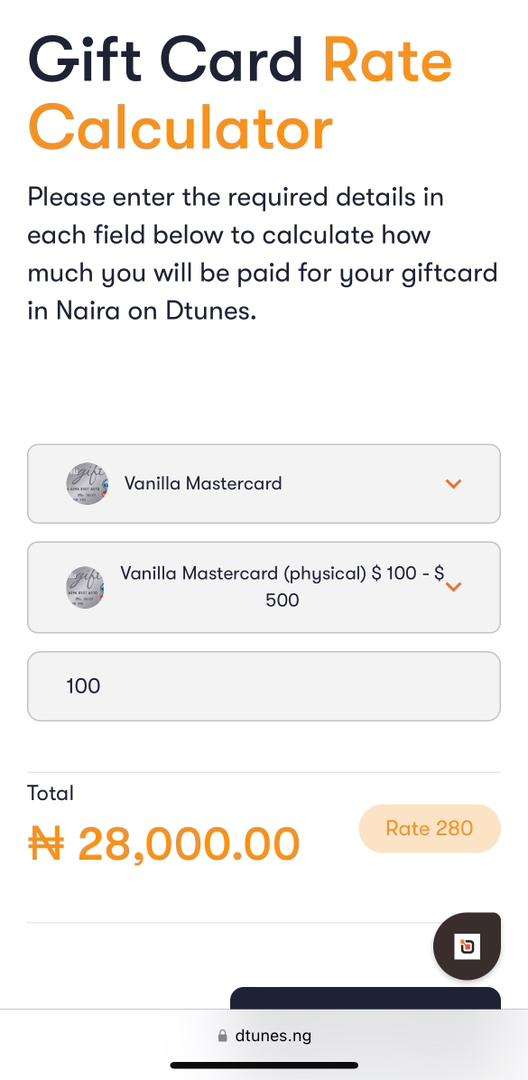

To calculate the value of a $100 Vanilla Mastercard in Naira, you can multiply the amount in USD by the current exchange rate. For example, if the exchange rate is 1 USD to 580 NGN, the value of a $100 Vanilla Mastercard would be 100 USD * 580 NGN/USD = 58,000 NGN.

The price of a $100 Vanilla Mastercard gift card in Naira is between 58,000 and 72,000.

How to check the updated Vanilla Mastercard rate in Naira

Checking the updated Vanilla Mastercard rate in Naira is crucial for obtaining an accurate conversion value. There are several ways to do this.

To check the updated Google Play gift cards rate yourself, you can visit the Dtunes website or app. They provide real-time rates for various gift cards, including a $100 Vanilla Mastercard gift card in Naira.

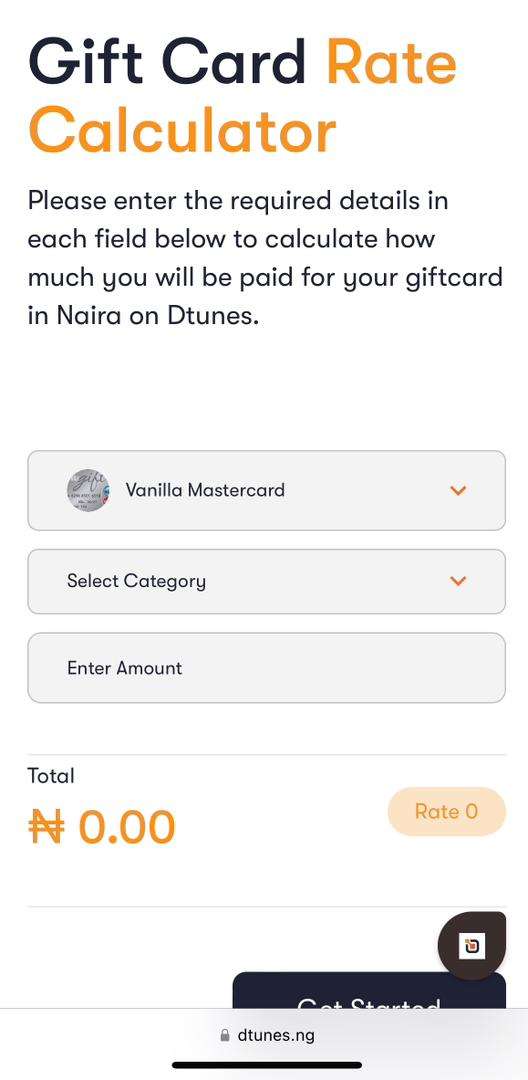

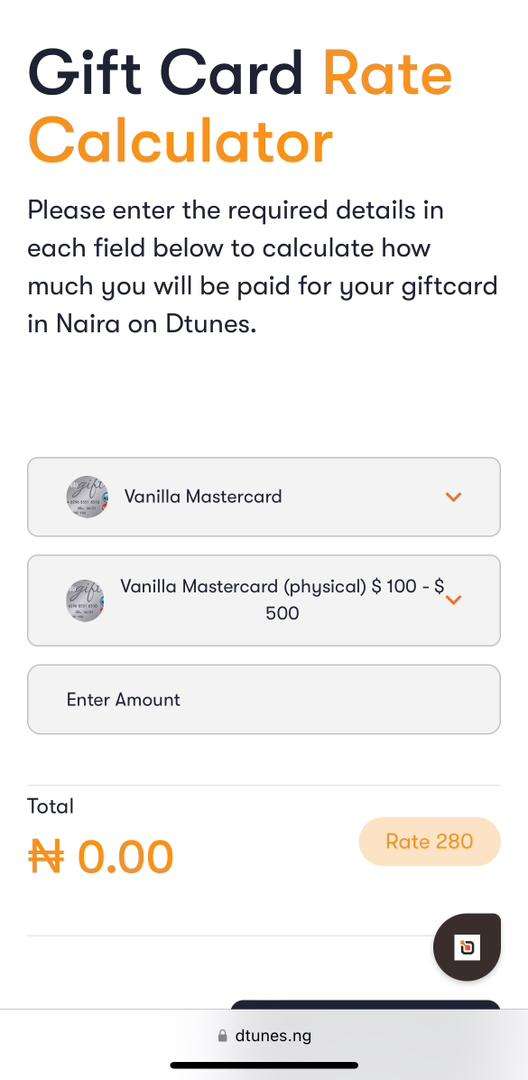

Here’s how to check Vanilla Mastercard gift card rates in Naira on the Dtunes website:

- Visit www.dtunes.ng

- Click on Rate Calculator which is located in the top right menu bar

- Select your gift card (Vanilla Mastercard in this case)

- Select the category of gift card (physical or e-code) and the range your gift card belongs in

- Enter the amount

The rate and total are shown and you can see what you’ll be getting.

How to sell Vanilla Mastercard gift card in Nigeria

If you have a Vanilla Mastercard gift card and wish to sell it in Nigeria, there are a few steps you can take:

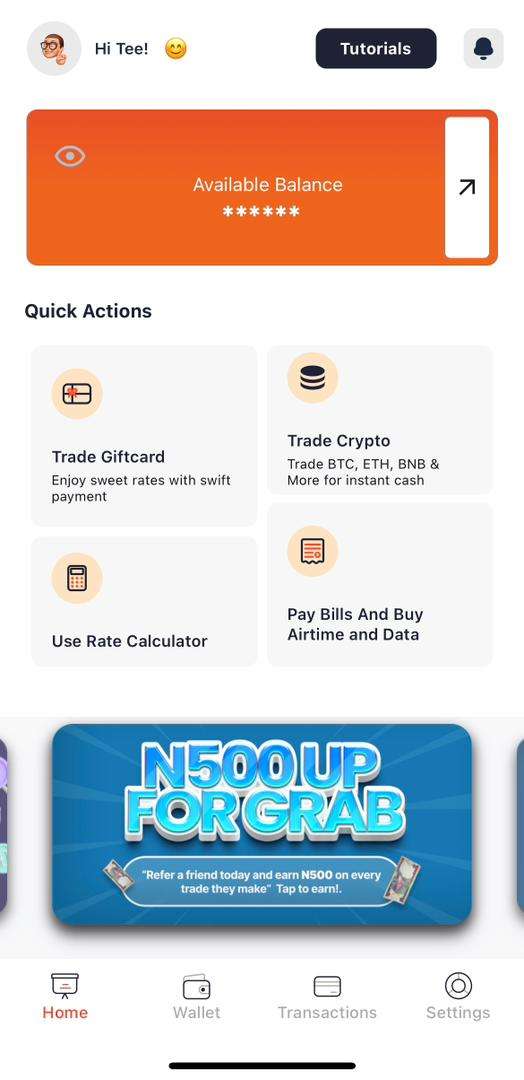

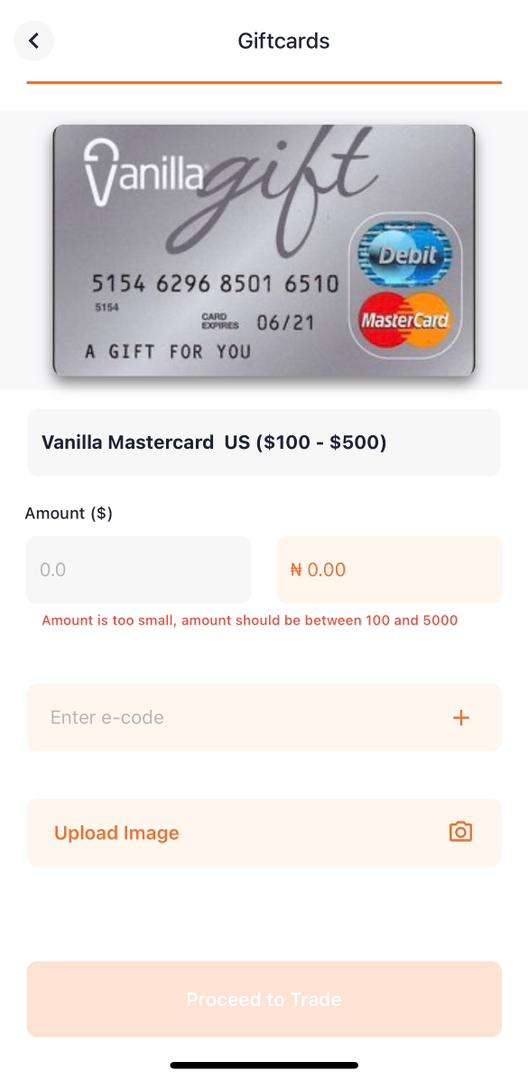

The first thing you want to do is to download the Dtunes app either on the Google play store for Android or on the app store for iOS. Then create an account if you don’t have one. It is free and it takes less than 3 minutes to create.

- Log into your account

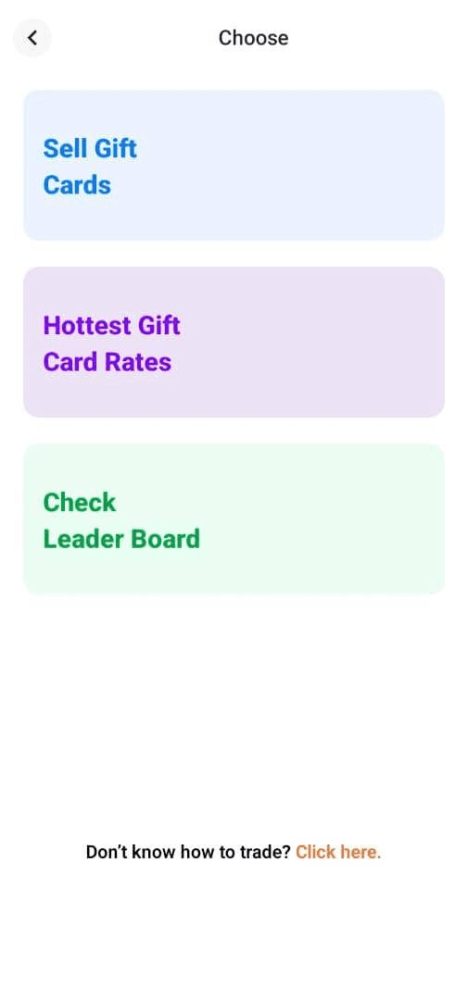

- Click on “Trade Giftcard” on the homepage

- Choose “Sell Gift Cards”

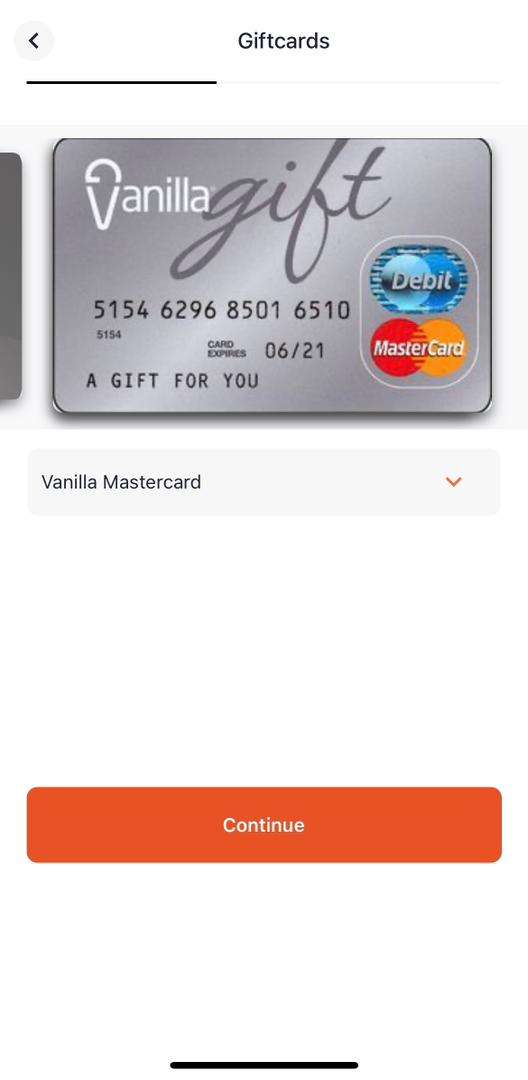

- Choose the type of gift card you want to sell (Vanilla Mastercard in this case) and ‘continue’

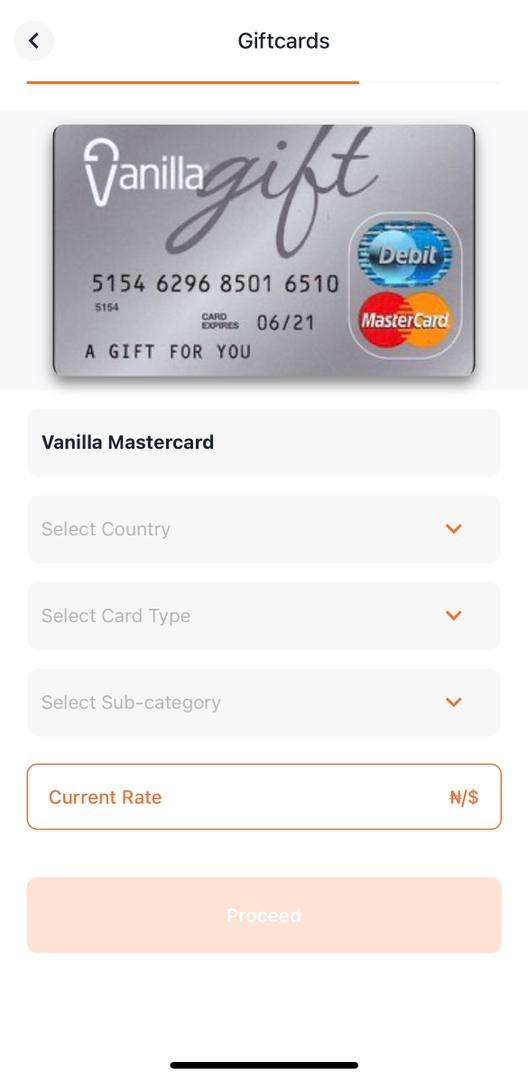

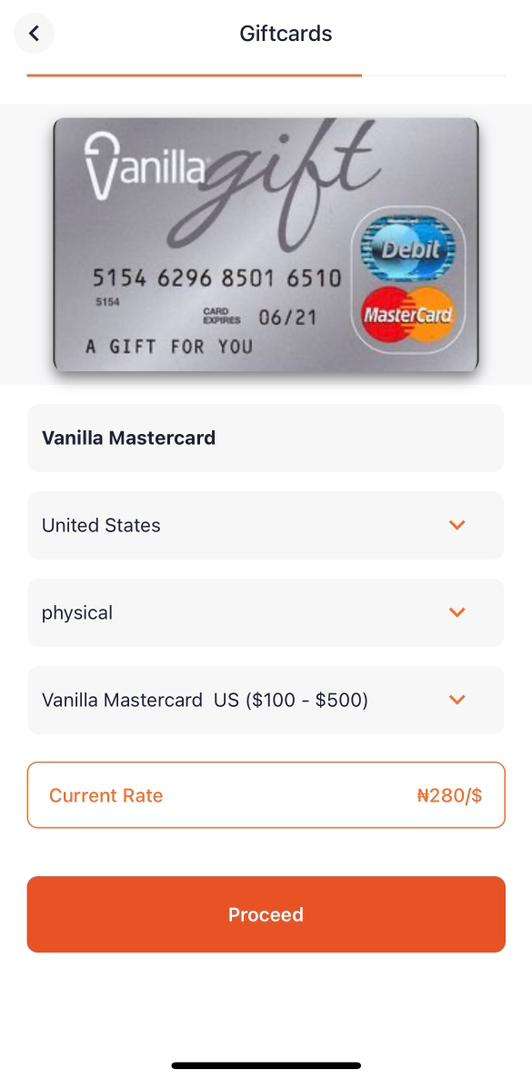

- Fill in the necessary details such as country, card type (physical or ecode), and then the subcategory (receipt/no receipt, debit receipt, credit card, etc)

- The rate is displayed, and then you upload your image (physical cards) or type in your code (ecode)

- Then proceed to trade.

Minutes after your gift card image is approved and the transaction is done, payment is made immediately.

In conclusion, a $100 Vanilla Mastercard in Naira depends on the current exchange rate between USD and NGN. As a prepaid debit card, Vanilla Mastercard offers a secure and convenient payment method for various purposes, similar to Vanilla Visa. However, they operate on different card networks.

Tobi brings stories to life as the Content Writer and Creator at Dtunes, blending creativity with strategy to connect with audiences. When she’s not crafting content, you’ll find her traveling, meeting new people, or trying out exciting things.