Best Time to Sell Bitcoin: Day or Night?

The big question remains, what is the best time to sell Bitcoin? In the ever-evolving world of cryptocurrency trading, timing is everything. Investors and traders alike are constantly seeking the optimal moment to buy or sell their digital assets, and Bitcoin, being the pioneer in the crypto space, is no exception. One of the critical questions that often arises is, “What is the best time to sell Bitcoin: day or night?” In this article, we’ll explore various factors influencing the decision and shed light on the dynamics that may affect Bitcoin prices during different times of the day.

What is Bitcoin?

Bitcoin is a decentralized digital currency that operates on a peer-to-peer network, allowing users to send and receive payments without the need for a central authority like a government or financial institution. Introduced in 2009 by an anonymous person or group using the pseudonym Satoshi Nakamoto, Bitcoin is often regarded as the pioneer of cryptocurrencies. Its underlying technology, blockchain, is a distributed ledger that records all transactions across a network of computers.

Bitcoin transactions are verified by network nodes through cryptography, and the details are stored in blocks that are linked together, forming a secure and transparent chain. The finite supply of 21 million bitcoins adds scarcity to the cryptocurrency, creating a deflationary aspect. Users can acquire bitcoins through a process called mining, where powerful computers solve complex mathematical problems to validate transactions and add them to the blockchain.

Bitcoin’s value is determined by market demand and supply dynamics, with its price known for its volatility. Beyond being a medium of exchange, Bitcoin is often seen as a store of value and a hedge against inflation. Its decentralized nature and the pseudonymous transactions it facilitates have contributed to its appeal, sparking discussions about the future of money and the broader implications of blockchain technology.

Understanding Bitcoin Market Dynamics

Before delving into the specifics of the best time to sell Bitcoin, it’s crucial to understand the factors influencing its market dynamics. The cryptocurrency market operates 24/7, allowing for continuous trading across different time zones. Unlike traditional stock markets, crypto trading doesn’t have specific opening or closing hours. Instead, it operates on a decentralized network of exchanges worldwide, ensuring that trading is possible at any time.

Best Time to Sell Bitcoin: Day or Night

- Market Volatility:

- Daytime Volatility: Daytime trading is often associated with higher volatility due to increased market activity. The opening hours of major financial markets, such as those in the United States and Europe, see a surge in trading volumes. This heightened activity can result in rapid price movements, providing opportunities for both profit and loss.

- Nighttime Volatility: On the other hand, nighttime trading may experience lower volatility as major financial markets close. However, this doesn’t mean that opportunities for profit are nonexistent. Certain news events, developments in the crypto space, or geopolitical factors can still impact prices during the night.

- Liquidity:

- Daytime Liquidity: Daytime trading often benefits from higher liquidity, making it easier for traders to execute large orders without significantly impacting the market price. Increased liquidity can contribute to a smoother trading experience and better execution of trades.

- Nighttime Liquidity: While nighttime liquidity might be lower compared to the daytime, it doesn’t necessarily mean a lack of trading opportunities. Traders should be cautious of illiquid periods, especially during late-night hours when fewer participants are active.

- Global Market Influence:

- Daytime Influence: Daytime trading aligns with the operational hours of major financial hubs, such as New York and London. News releases, economic indicators, and institutional trading activities during the day can have a substantial impact on Bitcoin prices.

- Nighttime Influence: Nighttime trading is influenced by markets in Asia and the Pacific region. Traders should stay informed about developments in these markets, as they can influence Bitcoin prices during nighttime hours.

- Psychological Factors:

- Daytime Psychology: Daytime trading may be influenced by psychological factors such as market sentiment, news flow, and the overall mood of investors. Traders should remain vigilant during the day, especially when major announcements or events are expected.

- Nighttime Psychology: Nighttime trading, being less active, may see less pronounced psychological reactions. However, unexpected news or events can still trigger market sentiment shifts.

- Technical Analysis:

- Daytime Technicals: Daytime trading allows for more accurate technical analysis, as there is a larger dataset of price movements and trading patterns. Traders relying on technical analysis may find daytime charts more reliable for decision-making.

- Nighttime Technicals: Nighttime trading may see less trading volume, potentially leading to price fluctuations that might not align with technical indicators. Traders should exercise caution and consider a broader timeframe for analysis during nighttime hours.

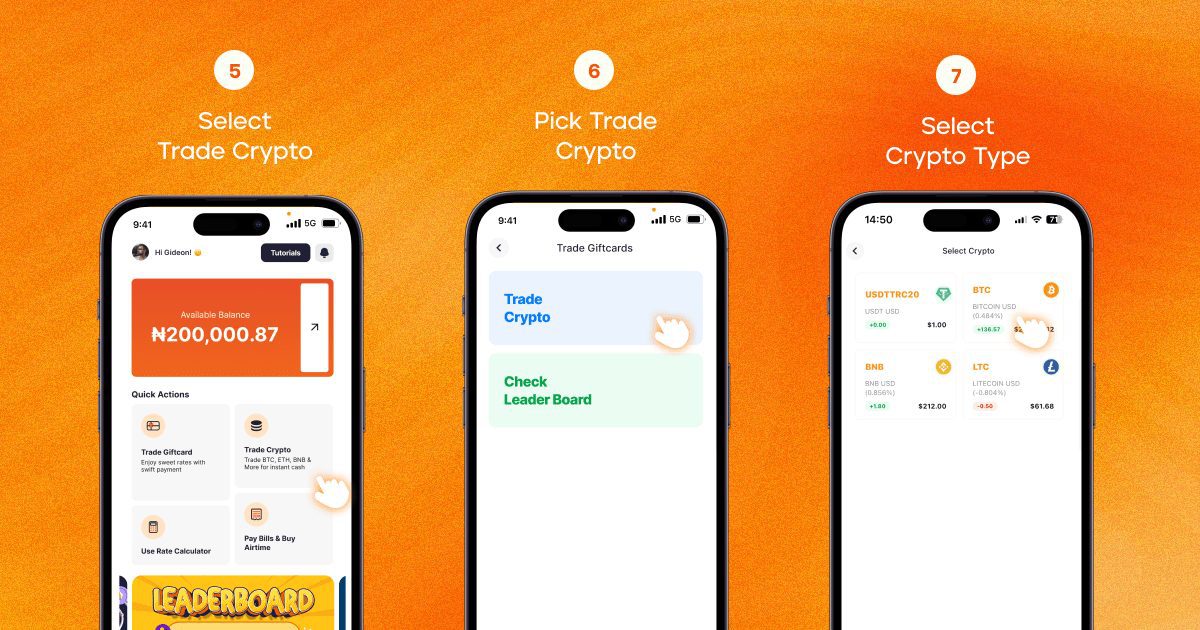

How to Sell Bitcoin on Dtunes

To begin the process, you’ll first need to sign up for an account on the Dtunes website or mobile app. Registration is simple, requiring only basic information such as your email address and a secure password. After your account is set up, you can proceed to sell your BTC for Nigerian Naira. Here’s a step-by-step guide on how to do it:

- Log into your account

- Click on “Trade Crypto” on the homepage

- Choose “Trade Crypto”

- Choose the type of crypto you want to sell (BTC in this case) and ‘continue’

- Enter the amount, and proceed to trade.

Conclusion

Determining the best time to sell Bitcoin ultimately depends on various factors, including individual trading strategies, risk tolerance, and market conditions. Both daytime and nighttime trading offer unique opportunities and challenges. Daytime trading may suit those who thrive on high volatility and want to take advantage of increased liquidity, while nighttime trading may appeal to those looking for a more subdued and potentially less crowded market.

Regardless of the chosen time, successful Bitcoin trading requires staying informed, conducting thorough analyses, and adapting to changing market conditions. Traders should remain vigilant, keep abreast of global developments, and be ready to adjust their strategies based on the dynamic nature of the cryptocurrency market. As with any investment, it’s crucial to conduct thorough research and, if necessary, seek advice from financial professionals before making trading decisions.

Tobi brings stories to life as the Content Writer and Creator at Dtunes, blending creativity with strategy to connect with audiences. When she’s not crafting content, you’ll find her traveling, meeting new people, or trying out exciting things.

![[elementor-template id="6995"]](https://dtunes.ng/blog/wp-content/uploads/2024/08/Latest-DtunesjArtboard-1-copy-41-768x432.jpg)